Mega Doctor News

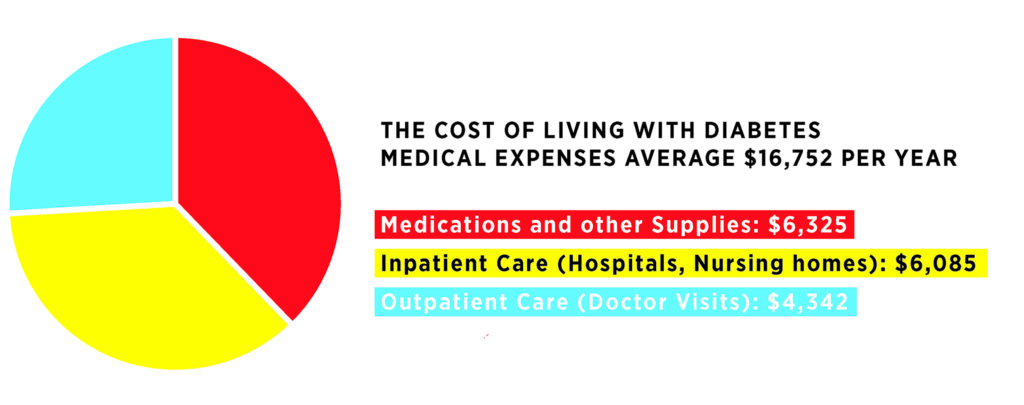

(Family Features) Managing a chronic disease takes plenty of special planning and attention, and in many cases, a lot of money. In some cases, the expenses associated with disease management are overwhelming, forcing patients to skip essential treatments or medication and risk serious health complications.

One example is diabetes. A study published in the “Journal of American Medicine” found that 1 in 4 individuals with diabetes had rationed their insulin, which can impact short- and long-term health. Since 2002, the list price of insulin has risen, often costing customers without health insurance or on high-deductible insurance plans upwards of $1,000 for a one-month supply.

Consider these ideas to help manage the expense associated with a chronic disease:

1. Health Insurance

Whether you have a chronic condition or you’re generally healthy, it’s important to understand the different types of health insurance available to you. Commercial health plans can be purchased by anyone and may be available through your employer, or you may be eligible for government-funded health care, but there are numerous other options and variables to consider.

Understanding the costs associated with insurance plans means taking into account both your monthly premium and out-of-pocket costs like co-pays, co-insurance and deductibles. When choosing a plan, decide whether you’d rather pay a higher amount each month (premium) and less when you see the doctor (co-pays, co-insurance or deductible), or if you’d prefer to pay less each month and more when you need to see the doctor or fill prescriptions.

Another consideration is the plan’s network. There can be a significant budget impact when you see doctors in-network vs. out-of-network. Other potential cost-saving options include health savings accounts or flexible spending accounts, which might save you tax dollars.

2. Doctor Visits

Avoiding visits to the doctor because of the expense can end up costing more in the long run if you leave serious symptoms untreated or fail to properly manage a chronic condition. Make sure you understand all costs associated with your visits, including what’s covered by insurance, your co-pay and any out-of-pocket costs. Labs and tests aren’t always covered, and certain conditions like diabetes can require many test-related expenses. Sometimes saving money can be as simple as having lab work done at an in-network facility and sent to your doctor.

In addition to a primary care doctor, many patients with diabetes also see an endocrinologist and have more frequent visits to the eye doctor. Indirect costs like transportation and childcare may also impact the overall expense of a visit.

3. Prescription Drugs

Doing your research can make a major difference in what you pay for your prescriptions. For many conditions, such as diabetes, the cost of medication may make it tempting to skip doses to make a prescription last longer, but that can have dire medical consequences.

Instead, conduct price checks with various pharmacies and discuss your medication options with your doctor, including which of your prescriptions have generic alternatives available. If a generic is a possibility and your doctor believes it’s a good match for your condition, be sure the prescription notes that substituting is allowed. You can also look into coupon savings and patient assistance plans.

In addition, some programs are available to help people with certain conditions. For example, GetInsulin.org, created by nonprofit organization Beyond Type 1, is a one-stop tool for anyone with diabetes who is having trouble accessing affordable insulin in the United States.

“High-quality, modern insulin must be available to people with diabetes regardless of employment or insurance status, across all demographics, without barriers and at an affordable and predictable price point,” said Thom Scher, CEO of Beyond Type 1.

Through the website, users answer a few questions and receive customized action plans to guide them through the access solutions that best serve their unique circumstances such as location, insurance type, income and prescription.

4. Medical Equipment

Devices like oxygen tanks, pacemakers, blood glucose monitors and CPAP machines for sleep apnea play vital roles in treating serious medical conditions. If you’re worried about the cost of equipment recommended to help you navigate a short- or long-term diagnosis, work with your doctor and insurance company to figure out the most cost-effective method to achieve your treatment goals.

5. Emergency Care

A medical emergency isn’t only a drain on your physical and mental well-being, it can deliver a major blow to your finances. Emergency care can cost thousands of dollars per visit, especially with high-deductible insurance plans. Some conditions like diabetes are associated with a higher likelihood of emergency care needs for complications such as diabetic ketoacidosis and severe hypoglycemia. To offset the impact of potential emergency care expenses, plan ahead and build a savings account for your medical needs.

6. Food

Certain diets cost more to maintain, and that can be especially true when you’re eating to accommodate a medical need. When planning food costs, be sure to account for the foods you’ll eat regularly, as well as the extras you’ll need, such as glucose gummies and snacks to treat low blood sugar for those living with diabetes.

Learn about options to help manage your diabetes-related expenses at GetInsulin.org.

Searching for Solutions

After her father passed away from complications of uncontrolled diabetes, Christine Kanderski was determined to never relive that pain. This meant finding a way to afford treatment for her mother’s type 2 diabetes and her son’s type 1 diabetes.

“There was no way that my family and I were going to let diabetes take another one of our family members,” Kanderski said.

Kanderski budgeted for a laundry list of costs: appointments, health insurance, needles, test strips, glucose meters and insulin. One trick she found to save money was sharing supplies between her mother and son.

When things seemed hopeless, Kanderski reached out to the diabetes community for support and resources. Tools like GetInsulin.org can help people find affordable insulin. Users answer a few questions and receive customized action plans to guide them through solutions that best serve their unique circumstances.